In an increasingly volatile world, where political headlines shake global markets and financial forecasts are more unpredictable than ever, collectors and investors are asking the same question, where is a safe place to put capital?

For decades, fine art, vintage cars, and rare watches have offered more than a pastime for collectors, they’ve been some of the most resilient assets during times of uncertainty. Now, with a new wave of political and economic turbulence, including fresh tariffs, rising inflation fears, and global conflict, these collectibles are proving again to be not only enduring passions and a welcome distraction, but smart investments.

Recently, the United States government announced sweeping new tariffs on imported cars and car parts. Initially, this sparked concern across the collector car world, but a quiet addendum brought surprising relief. Vintage and classic cars over 25 years old were made exempt. While the exemption may on the surface have seemed technical, its implications for the collector and investor are profound.

The US administration’s rationale was clear; these are not ordinary cars. They are cultural treasures, moving stores of value, and in many cases, better economic contributors than the stocks they displace in collectors’ portfolios. By allowing the import of these prized vehicles at current rates, the US is effectively acknowledging their economic and cultural significance.

It’s a move that underscores a broader truth; rare vintage collectibles, whether cars, art, or watches, are increasingly being treated as aspirational assets. Just like a Picasso or a 1960s Ferrari, an exceptional Rolex or Patek Philippe is an item of long-term value with global appeal. And for American collectors in particular, these watches are becoming even more attractive.

“Every time a collector purchases a watch at auction and brings it into the United States, they are importing a cultural and financial asset,” says Davide Parmegiani, Co-Chairman of Monaco Legend Group. “Just like a vintage car or painting, these watches carry value, meaning, and prestige. They’re globally respected. And they’re finite. That’s what gives them their power in the financial markets.”

In an era where currencies fluctuate and stocks are tied to ever-shifting policies, rare watches offer something entirely different, physical value, historical importance and global liquidity. The finest examples, watches with impeccable provenance, unique configurations or in exceptional condition, are not just trophies. They are time-tested investments that continue to appreciate, year after year and auction after auction.

As pending new regulations create barriers for luxury imports, timepieces already in the hands of collectors, or held by top auction houses with strong global reach, become even more valuable. It’s simple supply and demand. The more difficult it is to acquire something, the more coveted it becomes.

This year alone, we’ve already seen record-setting sales across the art, watch, and car markets, despite economic headwinds. Discerning collectors understand that rare doesn’t mean risky. In fact, the opposite is often true. The most significant vintage watches have outperformed countless other investment categories over the past 20 years. Their value is not tied to quarterly earnings or tech trends, but to heritage, craftsmanship, connoisseurship and scarcity.

And unlike many financial instruments, a great vintage watch brings daily joy. It’s an investment you can wear, share, and pass down. It’s also increasingly protected from new economic threats. If vintage cars have already been granted a tariff exemption due to their collectible status, is it only a matter of time before watches follow suit in policy? If not in regulation, then certainly in perception.

As Monaco Legend Group Chairman, Davide Parmegiani points out: “We’re seeing a shift. People are moving away from speculation and back toward tangible value. The best watches in the world are not just watches—they’re historical artefacts. They’re art. And right now, they’re a very smart place to put your money.”

Monaco Legend Group witnesses this firsthand every season. New bidders from around the globe are entering the market, looking for tangible, timeless value. Collectors are refining their focus toward pieces that are rare, significant, and in exceptional condition. Watches once considered ‘niche’ are now achieving global demand—and the momentum shows no signs of slowing.

In uncertain times, rare watches are not just a passion; they’re a haven!

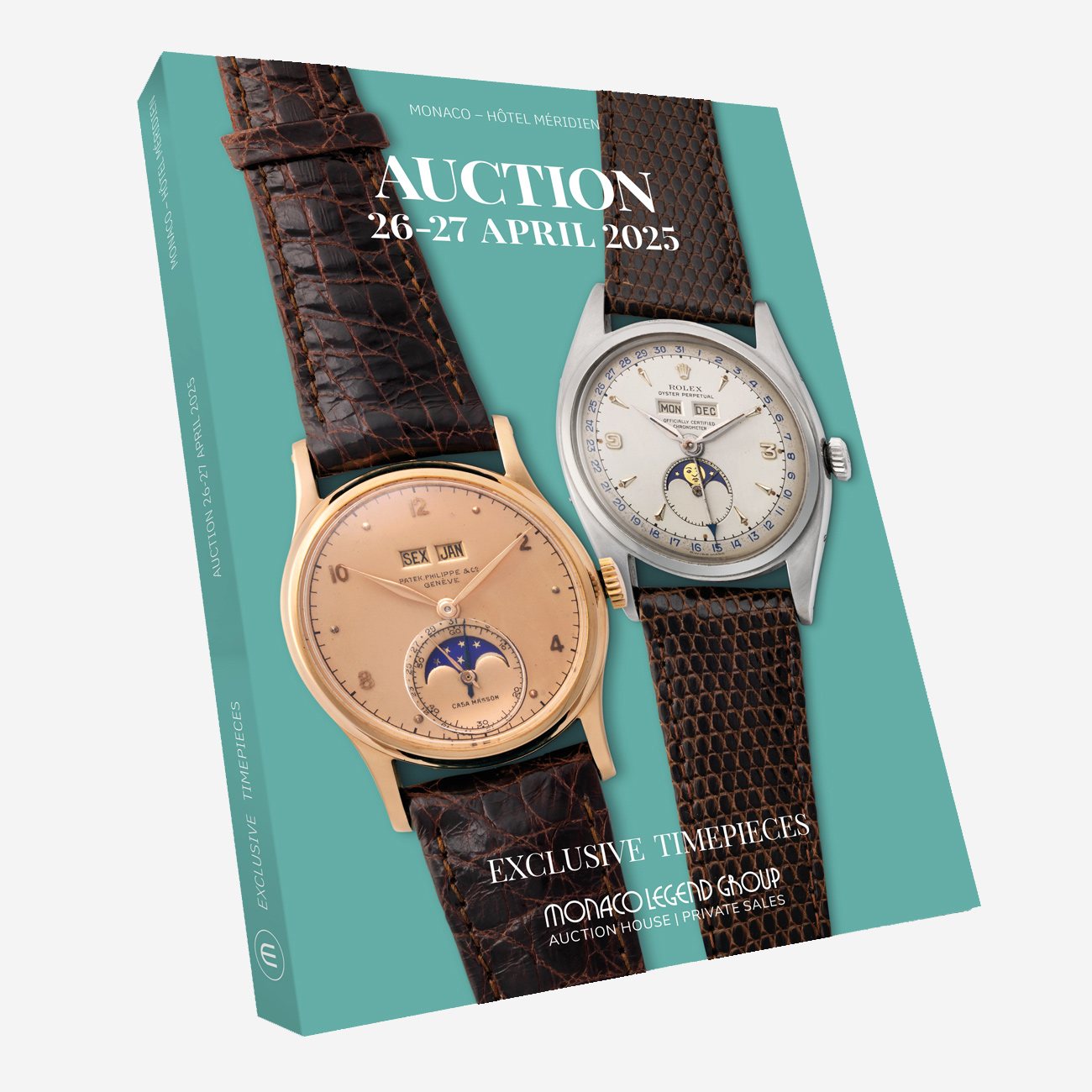

With our Exclusive Timepieces auction taking place this April in Monaco, there has never been a more compelling moment to acquire a true collector’s piece. The world may be changing, but excellence, rarity, and history will always hold their value.

Only one week left to register before the auction begins!